Carbon Trading Market

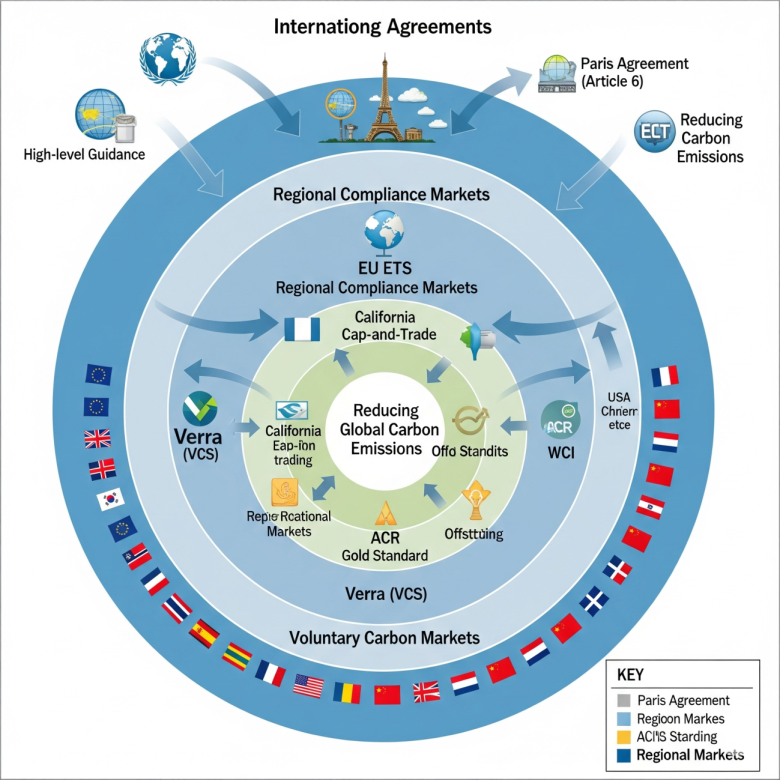

Carbon trading is an umbrella term for market-based mechanisms designed to reduce greenhouse gas emissions by creating a financial value for the right to pollute. These mechanisms are broadly categorized into two types: compliance markets and voluntary markets.

1. Compliance Markets (Cap-and-Trade)

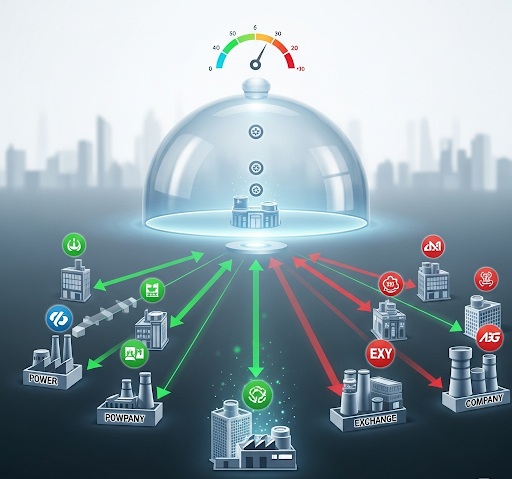

This is the most well-known form of carbon trading. It’s a regulatory approach where a government or international body sets a strict limit, or “cap,” on the total amount of emissions allowed.

Step-by-Step Process:

Set the Cap: A governing body determines the maximum total amount of emissions allowed for a specific region or industry. This cap is designed to decrease over time.

Issue Allowances: The government issues a limited number of carbon allowances, where each allowance grants a company the right to emit one metric ton of CO2e. The total number of allowances issued equals the cap.

Allocate and Trade: Allowances are distributed to companies (either through auctions or for free). Companies that can reduce their emissions cheaply can sell their excess allowances to other companies that find it more expensive to do so. This creates a market where the price of pollution is set by supply and demand.

Compliance: At the end of a set period, companies must surrender enough allowances to cover all of their emissions. Failure to do so results in heavy fines.

Applications:

EU Emissions Trading System (EU ETS): The world’s largest cap-and-trade market, covering emissions from power stations, industrial plants, and airlines in Europe.

California Cap-and-Trade Program: A major regional system in the United States that covers a significant portion of the state’s economy.

Voluntary Markets (Carbon Offsets)

This mechanism operates outside of government mandates and is driven by businesses and individuals who voluntarily choose to compensate for their emissions. Instead of trading pollution permits, they buy carbon offsets.

Step-by-Step Process:

Project Development: An organization develops a project that either prevents new emissions or removes existing emissions from the atmosphere. Examples include reforestation, renewable energy projects in developing nations, or methane capture from landfills.

Verification: The project must be independently verified by a third-party standard (like Verra or Gold Standard) to ensure the emissions reductions are real, additional (wouldn’t have happened otherwise), permanent, and not double-counted.

Credit Issuance: Once verified, the project is issued carbon offset credits, with one credit representing one ton of CO2e that has been reduced or removed.

Purchase and Retirement: A company or individual voluntarily buys these credits to “offset” their own carbon footprint. Once purchased, the credit is permanently “retired” on a public registry, ensuring it cannot be used again.

Applications:

Corporate Net-Zero Goals: Companies like Microsoft and Disney purchase offsets to meet their voluntary net-zero or carbon-neutral commitments.

Aviation Industry: Airlines use offsets to manage emissions for international flights through programs like the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA).

Carbon Tax

While not a trading mechanism, a carbon tax is another significant carbon pricing tool used by economists to address the externality of pollution. It directly sets a price on carbon emissions rather than a limit on the quantity.

Step-by-Step Process:

Set the Tax Rate: A government sets a fixed tax rate per ton of CO2e emitted. This rate is typically applied “upstream,” meaning it’s levied on the producers or importers of fossil fuels.

Internalize the Cost: The tax increases the cost of fossil fuels, and this cost is passed on to consumers and businesses. This incentivizes them to reduce their fuel consumption and switch to cleaner, cheaper alternatives.

Revenue Generation: The tax revenue goes to the government, which can use the funds to lower other taxes, invest in green infrastructure, or provide rebates to citizens.

Applications:

Sweden’s Carbon Tax: Sweden has one of the world’s highest carbon taxes, which has been instrumental in decoupling its economic growth from its emissions.

Canada’s Federal Carbon Pricing System: Canada has a federal carbon tax that applies to provinces and territories that don’t have their own equivalent pricing system.

Factors Influencing Carbon Prices

The price of carbon is dynamic and influenced by a wide range of factors, primarily driven by supply and demand, economic conditions, and policy decisions.

1. Supply and Demand Dynamics

Supply: In a cap-and-trade system, the government controls the supply of carbon allowances by setting and reducing the cap over time. The supply of carbon offset credits in voluntary markets is determined by the number of certified projects. A tighter cap or fewer available projects leads to a higher price.

Demand: Demand for carbon credits is driven by the need for companies to meet regulatory obligations or fulfill voluntary sustainability commitments. When economic activity is high, industrial production and energy consumption increase, leading to higher emissions and thus higher demand for credits, which drives up their price. Conversely, an economic downturn can reduce industrial output and lower the demand for allowances.

2. Regulatory and Policy Factors

Cap-Setting: The most direct influence on price is the stringency of the cap. A more ambitious cap, with a faster rate of reduction, creates greater scarcity and pushes prices higher.

Policy Announcements: Major policy decisions or even the prospect of future regulations can significantly impact market sentiment and price.For example, a government announcing a stricter emissions target for the coming years will cause prices to rise as market participants anticipate a tighter supply.

Rules on Offsets: The rules governing whether and how companies can use carbon offsets can impact price. If a compliance market allows companies to use a large number of cheap voluntary offsets, it can suppress the price of compliance allowances.

Market Stabilization Mechanisms: To prevent excessive price volatility, some systems (like the EU ETS) have mechanisms to automatically add or remove allowances from the market. These mechanisms are designed to stabilize prices, preventing them from becoming either too high or too low.

3. Macroeconomic and External Factors

Energy Prices: The price of carbon is highly correlated with fossil fuel prices. When natural gas prices are low, power plants might switch from more expensive coal to gas, which has lower emissions. This would reduce the demand for carbon allowances, putting downward pressure on their price.

Technological Innovation: Advances in renewable energy, energy efficiency, and carbon capture technologies can reduce the cost of emissions reduction. As these solutions become more affordable, companies have less need to purchase carbon credits, which can reduce their price.

Public Perception and Corporate Commitments: In voluntary markets, prices are heavily influenced by the public perception of climate action. As companies face greater pressure from investors and consumers to demonstrate sustainability, their demand for high-quality carbon offsets increases, driving up prices.

4. Project-Specific Factors (for Voluntary Credits) 🌱

Project Type: Credits from “carbon removal” projects (e.g., reforestation, direct air capture) often command a higher price than “emissions avoidance” projects (e.g., renewable energy) because they are seen as having a more direct and permanent climate benefit.

Project Quality and Co-Benefits: Credits from projects with a reputable certification (like Gold Standard) that also provide social or environmental co-benefits (e.g., job creation, biodiversity protection) are generally more expensive and in higher demand.

Vintage: The year the credit was generated also matters, with newer credits typically commanding a premium.