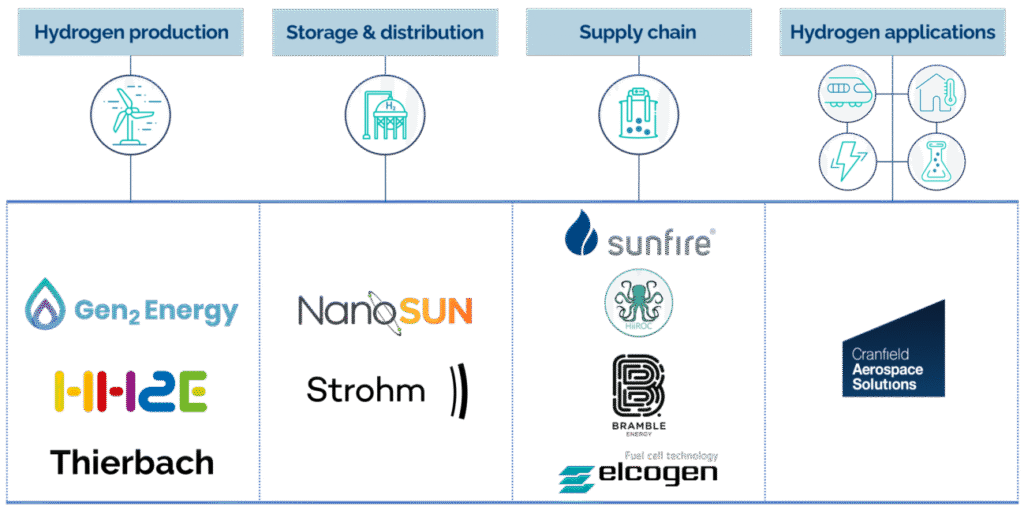

Bramble Energy Limited

UK-based fuel cell and portable power solutions company

Category – Supply chain

Co-investors –IP Group, BGF, Parkwalk, UCL Technology Fund

Why Invested

Pioneering revolutionary fuel cell design and manufacturing techniques

Novel printed circuit board design PCBFC™ – low cost, scalable and recyclable fuel cell modules

Developing high-power density, mobility fuel cell systems

Launched a portable power product range

Elcogen AS

Fuel cell and electrolyser manufacturer with presence in Estonia and Finland

Category – Supply chain

Co-investors – Biofuel OÜ, VNTM Powerfund II

Why Invested

Amongst the world’s most advanced solid oxide specialists, with lower than-normal operating temperatures and superior economics

Developed a reversible ceramic technology that can convert hydrogen into emission-free electricity and vice versa

+10 year track record; over 60 established industrial customers worldwide

HiiROC Limited

Netherlands-based hydrogen pipeline company

Co-investors – Melrose Industries, Centrica, Hyundai, Kia, Wintershall Dea, VNG, Cemex

Why Invested

Enables low-cost, zero emission production of hydrogen, located at the point of demand

Highly scalable modular solution, producing 100kg / day of hydrogen from a single unit through to large plants capable of 100’s of tonnes / day of hydrogen, alongside carbon black

Strong growth potential in flare mitigation, grid injection, electricity generation, decarbonising industry, biomethane conversion and synthetic aviation fuel production

Sunfire GmbH

German industrial electrolyzer producer

Co-investors – Planet First Partners, Lightrock, SMS, Neste, CIP, Carbon Direct Capital Management, Blue Earth Capital, Amazon

Why Invested

Material, established electrolyzer producer with strong technology and growth potential

+10 year track record

Building a 500MW / annum electrolyzer production site in Germany by 2023 – with a further extension to gigawatt-scale already in planning

Gen2 Energy AS

Norwegian green hydrogen project developer

Category – Green Hydrogen production

Co-investors – HyCap, Vitol, Hoegh LNG, Knutsen Group

Why Invested

Up to 700MW green hydrogen projects in Norway, with expected production in 2025-2027

Specialist in low-cost 24/7 hydroelectric power

HGEN has follow-on investment rights in project SPVs

HH2E AG

German green hydrogen project developer with a focus on industrial customers

Category – Green Hydrogen production

Co-investors – Foresight Group LLP

Why Invested

Assessing 5 new projects for Final Investment Decision (“FID”)

Provides HGEN with investment rights in multiple large-scale industrial decarbonization projects

The new zinc electrolyser (or battery + alkali electrolyser) in combination with the high-temperature storage unit enables constant production with only a limited number of hours of renewable electricity supply

Thierbach Project

Development project for the construction of an industrial-scale green hydrogen production plant in Germany

Category – Green Hydrogen production

Co-investors – Foresight Group, HH2E

Why Invested

Projected to have the capacity to produce c.6,000 tonnes of green hydrogen per year during phase 1.

Further expansion phases could increase production to more than 60,000 tonnes in the medium term, which could result in over 10 million tonnes of greenhouse gas emissions avoided over the life of the project.

Large-scale customers across the energy, transportation and industrials sectors in Germany.

The operator (HH2E) is a specialist in developing projects to decarbonise industry across Germany using green hydrogen.

NanoSUN Limited

UK-based developer of hydrogen distribution and mobile refuelling equipment

Category – Storage & distribution

Co-investors – Westfalen Group

Why Invested

Provides flexible and low-cost connection between hydrogen customers such as truck stops, and concentrated hydrogen supply sources

Flat-bed solution with 60% lower cost than alternative systems

Accelerating large-scale roll out of fleets of hydrogen buses, trucks, vans and forklift

Strohm Holding B.V.

Netherlands-based hydrogen pipeline company

Category –Storage & distribution

Co-investors – Shell Ventures, Chevron Technology Ventures, Evonik Venture Capital, ING Bank N.V.

Why Invested

Global market leader in design and manufacturing of Thermoplastic Composite Pipe (“TCP”)

TCP is more cost-effective than steel pipe and has c.50% less greenhouse gas emissions on as-installed basis

TCP can transfer up to nine times the amount of energy compared to a cable, and can be used to store hydrogen

TCP’s flexibility, lack of corrosion, fatigue and embrittlement make it the superior pipeline solution for offshore wind farms, generating hydrogen

Cranfield Aerospace Solutions Ltd

UK-based passenger flight innovator, powering turboprop flight with hydrogen

Category – Hydrogen applications

Co-investors – Safran Ventures, Tawazun Strategic Development Fund, Motus Ventures

Why Invested

Aerospace market leader in the design and manufacture of new aircraft design concepts, complex modifications to existing aircraft and integration of cutting-edge technologies

Working on CAA certification of the Britten-Norman Islander passenger aircraft using hydrogen