Financial Model

Creating new financing models , an Approach of Euro India Consulting

To think a new financing models there is a need for fresh thinking particularly if cities are to scale up and roll out pilot projects more widely. But considering “technology risk” investor confidence is reduced if it is difficult to monetise the benefits of the project, although a project might offer a clear positive socioeconomic impact.

Hence the Challenge of Paying for Smart City Project, has put forward a new financial framework for smart cities and developing a

strategic plan to capitalize on the project’s strong points. This can help to improve the initiative’s “investment readiness” and its access to finance.

Its framework comprises a number of elements, including: a Strong business model, an innovative revenue model, prioritising asset recycling and value capture, futuristic novel funding options and private sector participation.

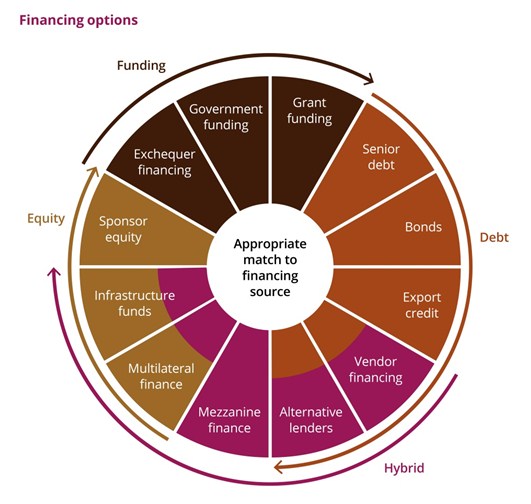

While there are numerous options available to source finance for smart cities investments, a challenge in taking advantage of many of these options is matching the project to the most appropriate financing tool. This requires that you fully understand the project, its potential cash flows, the range of financing options available (locally and internationally), and available procurement methods to government in order to deliver. For managing the sources of capital (debt or equity) for a given project requires effort understanding of the project’s fundamental components.

Smart cities projects may include traditional physical infrastructure assets, new technologies and connectivity, transportation systems, and safety and security features. They may also include aspects of a project associated with economic development, tourism, hot spots, citizen sociality, and sustainability.

Therefore it is important to develop a strategic plan to secure financing from different sources for different aspects of the project as required. Grouping various elements of a project matching specific financial investor criteria can make a smart city proposal.

Financing Channels used

- Project finance This channel analyses financials of a given project, and not on the business/enterprise as a whole. The earning is set according to the estimated cash flows and profits generated by the project.

- Traditional loans and leases It always involves a private equity partner and finance is done at the project level and the repayment comes from public sector or third-party/user payments over time.

- Vendor finance Private sector entities often join the projects as vendors rather than partners. An equipment vendor, an engineering contractor or another supplier will offer financing for the project. Because an equipment vendor may have a better understanding of a project’s technical risks and is more viable than a commercial lender to assume those risks.

For example, Cisco has created the $1 billion City Infrastructure Financing Acceleration Program (CIFAP), which provides debt and equity capital to finance Smart Cities implementations. A city can make a traditional loan arrangement with Cisco, or it can choose “as a service” financing (consuming the technology as a service rather than buying it up front) or revenue share financing, among other options.

- Consumption-based financing Project sponsor pays for technology based on usage and adjusts capacity up and down as needed. Financing is at the supplier level rather than project level.

- “As-a-service” financing Rather than purchasing technology, project consumes it as a service. Financing is at the supplier level.

- Concession financing Project gains the benefits of technology at little to no cost, while enjoying incremental revenues and cost savings.

- Revenue share financing Project obtains funding for technology investments in exchange for a share of the revenues from customer contracts. Revenues may be committed or uncommitted.

- Equity financing Scales business across multiple cities with capital and expertise from a strategic private Equity

- Mini-bonds. In 2014, to raise money for cultural and recreational facilities, the city of Denver issued $12 million worth of mini-bonds. For $500, any Colorado resident could purchase a nine-year bond, with a maturity rate of $750, or a 14-year bond, which will mature to $1,000.The entire offering sold out in one hour.

- Crowd Funding Cities can also use this form of citizen-inclusive participation and crowd funding to raise money for Smart Cities projects

Reward and risk Sharing PPP Finance Model Public-private partnerships (PPPs), where cities and private enterprises share both the risk and the reward involved in smart city projects, are one of the most popular options and there are a number of examples of these around the world. ). Under this model, the city chooses a private sector partner to, for example, design, build, finance, operate, and maintain (DBFOM) a project, and then transfer it back to the city at the end of a defined period and based on established performance requirements. The city benefits from the private partner’s expertise and experience, and the partner makes its money through user fees, other revenues, and/or shared cost savings attached to the project.

Value capture and asset recycling

Along with more traditional funding strategies, a city can use value capture to provide a contribution to funding for a smart city project. Direct value capture generates value directly within a project, using strategies such as revenue sharing, profit sharing, refinancing gain share, user fees, and impact fees.

Indirect value capture creates value as a result of government decisions (e.g., a zoning change) or investments (e.g., developing a new transit system) that benefit developers. A government might also capture more value from a project, for example, by leasing air rights above the property, or swapping a piece of public land that a developer wants for a piece of privately owned property.

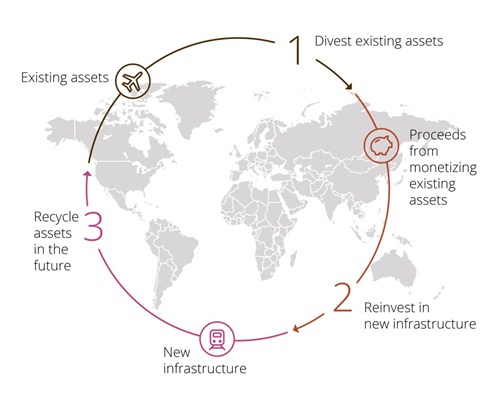

Another option is asset recycling. In this strategy, the government sells (or leases) a public asset to a private entity for value and then uses the proceeds to fund future investment. The government might sell an asset it no longer needs; sell an asset to take advantage of its current capital value and then lease it back for public use; or conduct an asset swap or share arrangement to help with a private sector development plan. In each case, the goal is to use existing assets to enhance the overall government portfolio while achieving value for money.

Procurement structures utilized

Just as different funding and financing strategies work best for different smart cities projects, so do different procurement structures, and specific procurement mechanisms are required in order to accommodate different funding/financing strategies.

The options include:

Direct Delivery:The public sector provides goods or services directly to the customer utilizing the public sector staff/assets.

Conventional Procurement: The public sector defines its requirement for goods and/or services, procures them via traditional procurement and contracting methods, and pays for them.

Operating Contracts:The public sector contracts with a vendor to provide goods and services. These contracts may cover a range of activities, from technical assistance to full responsibility for the operation and management of a public infrastructure asset. They are generally shorter term in nature.

Licensing: Typically used for procuring technologies, these agreements generally come in two varieties. The first is a perpetual license, which is a one-time, up-front purchase funded by the CAPEX budget. The other is a subscription license, supported with periodic payments from the OPEX budget.

Long-Term Lease: Leasing property or equipment, rather than buying, provides flexibility and reduces up-front costs.

Joint Venture (JV): In this Private Sector Participation (PSP) model, the public sector joins with the private sector to jointly deliver a service/asset in an effort to utilize the best of each party. In many cases, this structure is utilized by the public sector to involve itself in a project (often) without providing funding; however, it can make an asset available for use to the JV.

Public-Private Partnership (PPP): Under this structure, the government contracts with the private sector (usually long term) for the provision of a service. The delivery of the service may involve the construction of a related and underlying asset; however, payment is made based on performance and availability of the service. By the use of risk transfer, the public sector pushes manageable risks to the private sector to deliver value for money.

Franchising: An agreement to operate government-owned assets on a commercial basis to generate returns (e.g., rail operator contracts where government supplies the rail infrastructure).

Privatization: This is where the private sector is fully responsible for the design, delivery, and operation of projects that provide (or previously provided) a public service. The public sector has no direct control over these entities except for legislation and regulation. In certain cases, these project services may have been provided by government, and the private sector may acquire the project/asset for consideration.

Conclusion

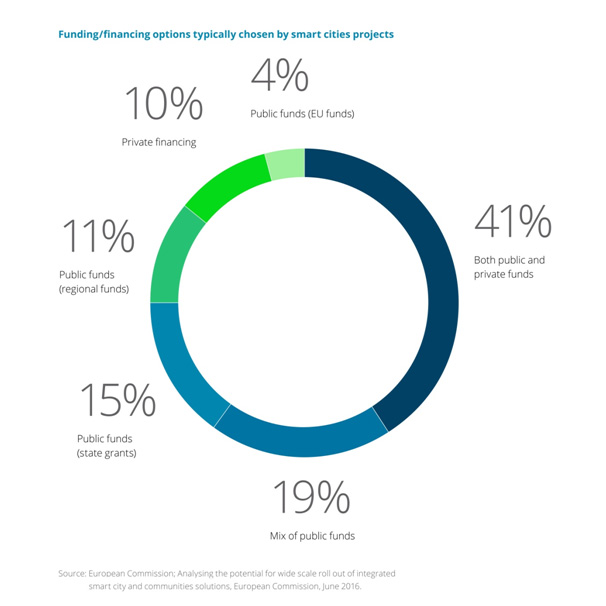

While the smart cities movement offers exciting new opportunities for governments, their citizens, and businesses, finding the money to support such products or services can be a complex undertaking. When government officials understand the full range of options for funding, financing, and procurement; analyse the advantages of each; and choose strategies that best fit their situation, they can vastly increase the odds that their smart city initiative will succeed.